ODO50, the ideal solution for people working on the road and all tax profiles

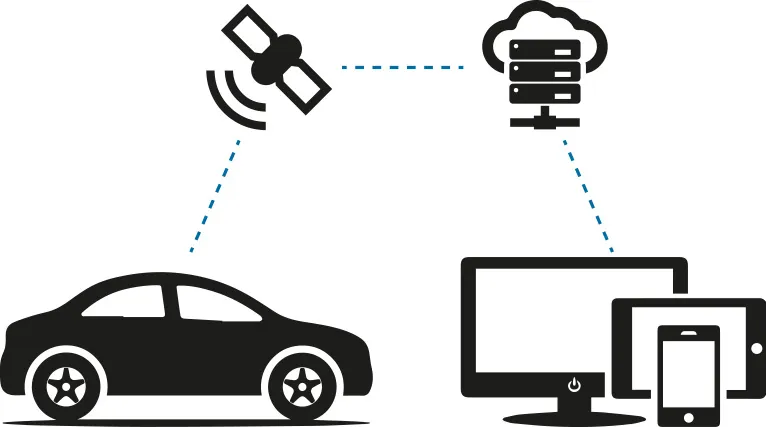

These days, you have to be able to justify your business trips to claim them on your taxes. The best way to do so is to keep a mileage logbook that meets government requirements. In the absence of such a log, it is painstaking and tedious to determine the percentage of trips taken for business in a way that maximizes income tax refunds, input tax refunds and social benefits while protecting you in the event of a tax audit.

order