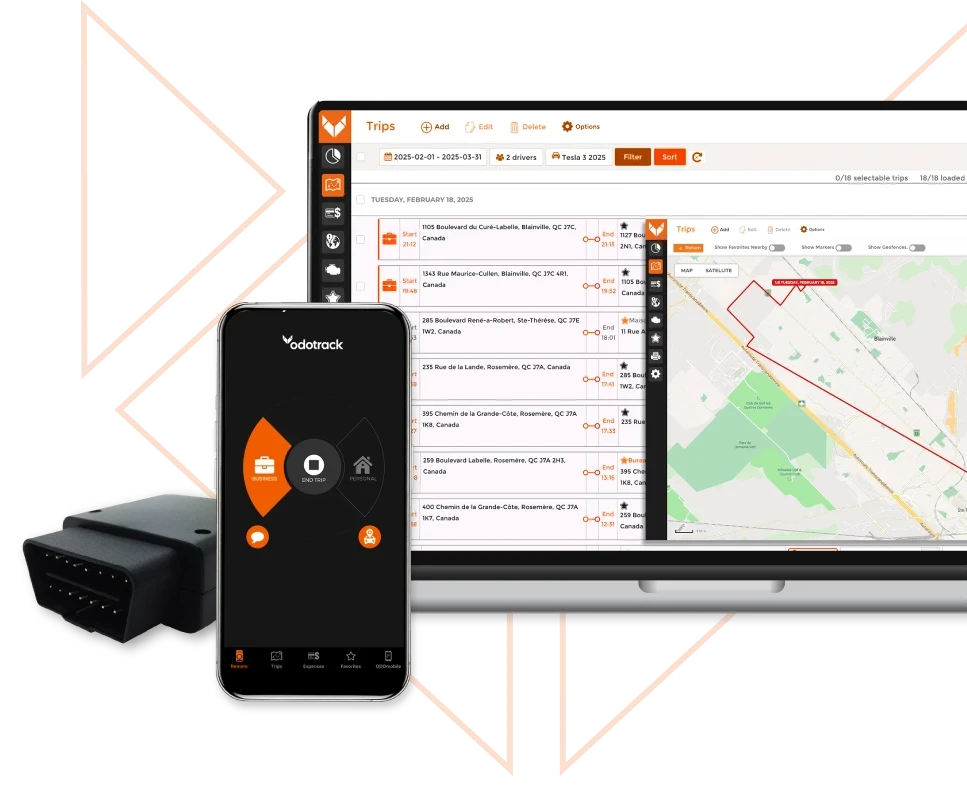

I don't drive much, less than 20,000 km per year. Is it worth it ?

Yes. Even if you drive less than 20,000 km per year, tax law (CRA and Revenu Québec) requires that you keep a mileage log if you claim vehicule expenses or if your employer provides you with a vehicle that is also used for personal purposes.